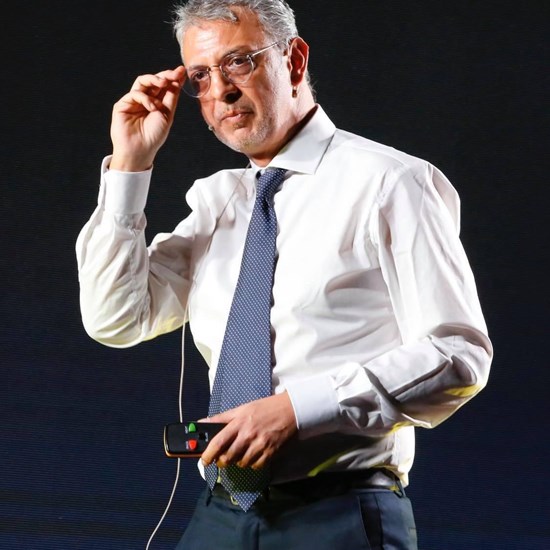

The Revenue Agency has issued clarifications regarding utility tokens, shedding light on the tax aspects to be considered. Daniele Marinelli (Ushare and DTSocialize) guides us through the writing of the piece.

Utility Tokens: what they are

Utility tokens are tokens created to provide both a specific service to their owners and preferential treatment compared to others. Often, companies benefit from these tokens to generate hype and value for a particular product or service. Unlike security tokens, holders of utility tokens are not offered participation in the company that issues them; therefore, their function cannot be defined as an investment opportunity. Moreover, these types of tokens represent a significant portion of all tokens issued in Initial Coin Offerings (ICOs), which constitute a different type of funding born from blockchain technology and mainly used by startups aiming to realize a specific project.

Revenue agency’s clarifications on Utility Tokens

Once the meaning and functioning of utility tokens are clarified, we can move on to the clarifications provided by the Revenue Agency. According to the agency, the same tax regulatory framework applied to vouchers should not be applied to utility tokens. This clarification arose from a query by a company that protects copyright by notarizing it on the blockchain, ensuring its immutability. The company’s intention, to raise funds needed to complete its technological infrastructure and cover expenses, is to initiate an ICO by issuing utility tokens, thus depositing its music at a favorable price.

The precedent of the European Commission

Previously, on December 2, 2019, and June 12, 2020, during meetings of the VAT Committee, the European Commission had expressed strong doubts about categorizing utility tokens under the voucher regulations. According to the European Commission, the voucher regulations do not apply to utility tokens since, after issuance, their nature changes to become:

A virtual currency

An investment instrument, susceptible to being traded on the secondary market for profit (so-called hybrid token).

Conclusions

In conclusion, according to the Revenue Agency, Daniele Marinelli, CEO of Ushare social profit marketing, emphasized that since utility tokens have a dual function (originating as financing tools and transforming into payment methods for discounted services), the same VAT treatment reserved for vouchers in ICOs cannot be applied.